Fall 2026 Incoming Freshman Class

Now that we have moved into January and our recruitment work is shifting from application generation to yield, this mid-year check-in assesses where the Fall 2026 freshman class currently stands, where enrollment pressure is emerging, and where targeted yield efforts are most likely to change the final outcome.

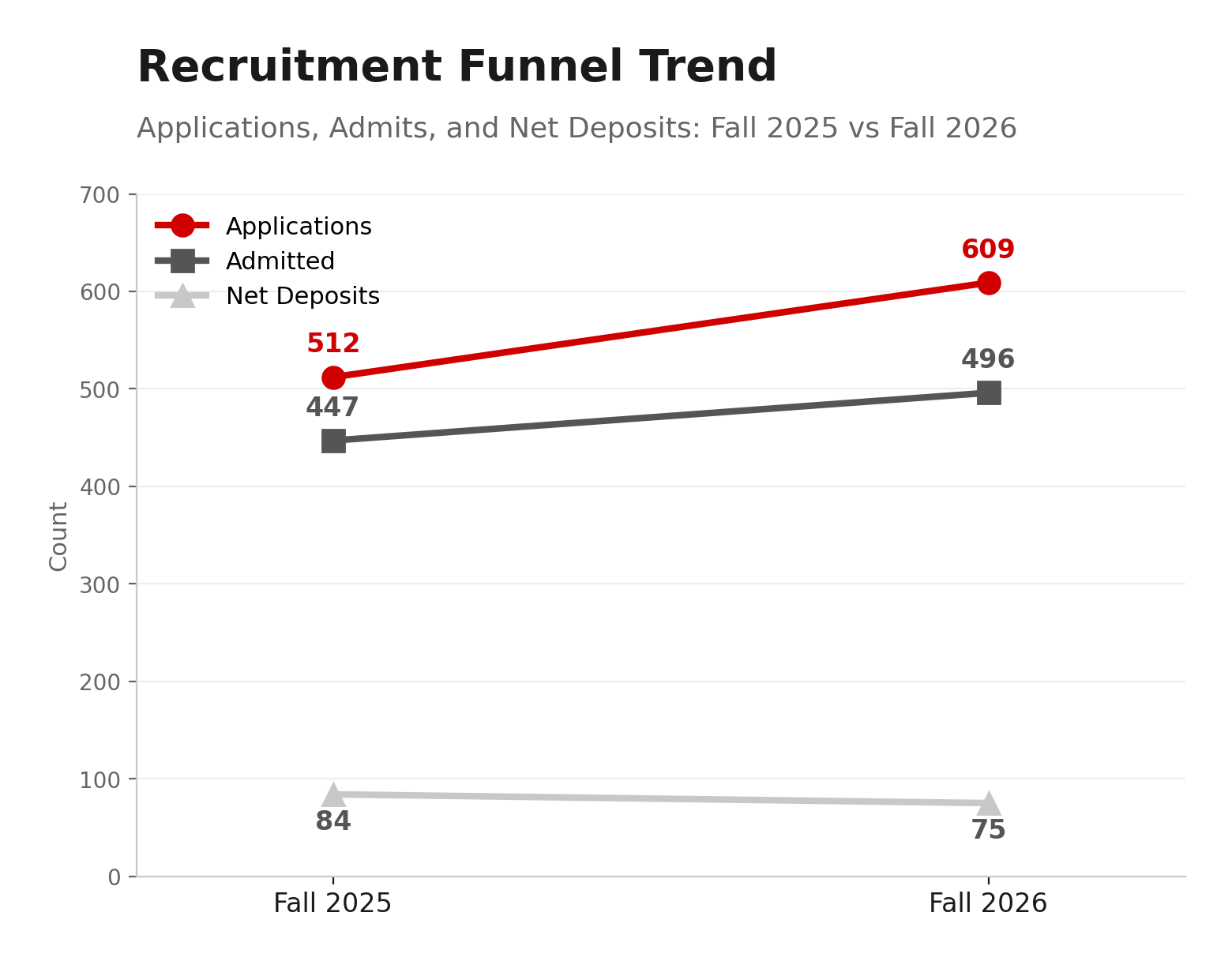

At this point in the cycle, the top of the funnel remains strong. The college has received 609 applications for Fall 2026, up from 512 at this time last year, an increase of 18.9 percent. Admitted students have also increased, from 447 to 496, representing 11 percent year-over-year growth. These trends continue to reflect strong demand for our academic programs and the success of early-cycle engagement strategies.

However, deposits have not kept pace with that growth. Net deposits currently stand at 75, down from 84 at this time last year, a decline of 10.7 percent. The divergence between increased interest and decreased conversion confirms that Fall 2026 enrollment pressure is concentrated in yield. Put simply, we are bringing more students into the funnel, but we are not closing at the same rate we did last year. The remainder of this analysis focuses on where that softening is concentrated and what it suggests about next steps.

Residency and Nebraska regional patterns

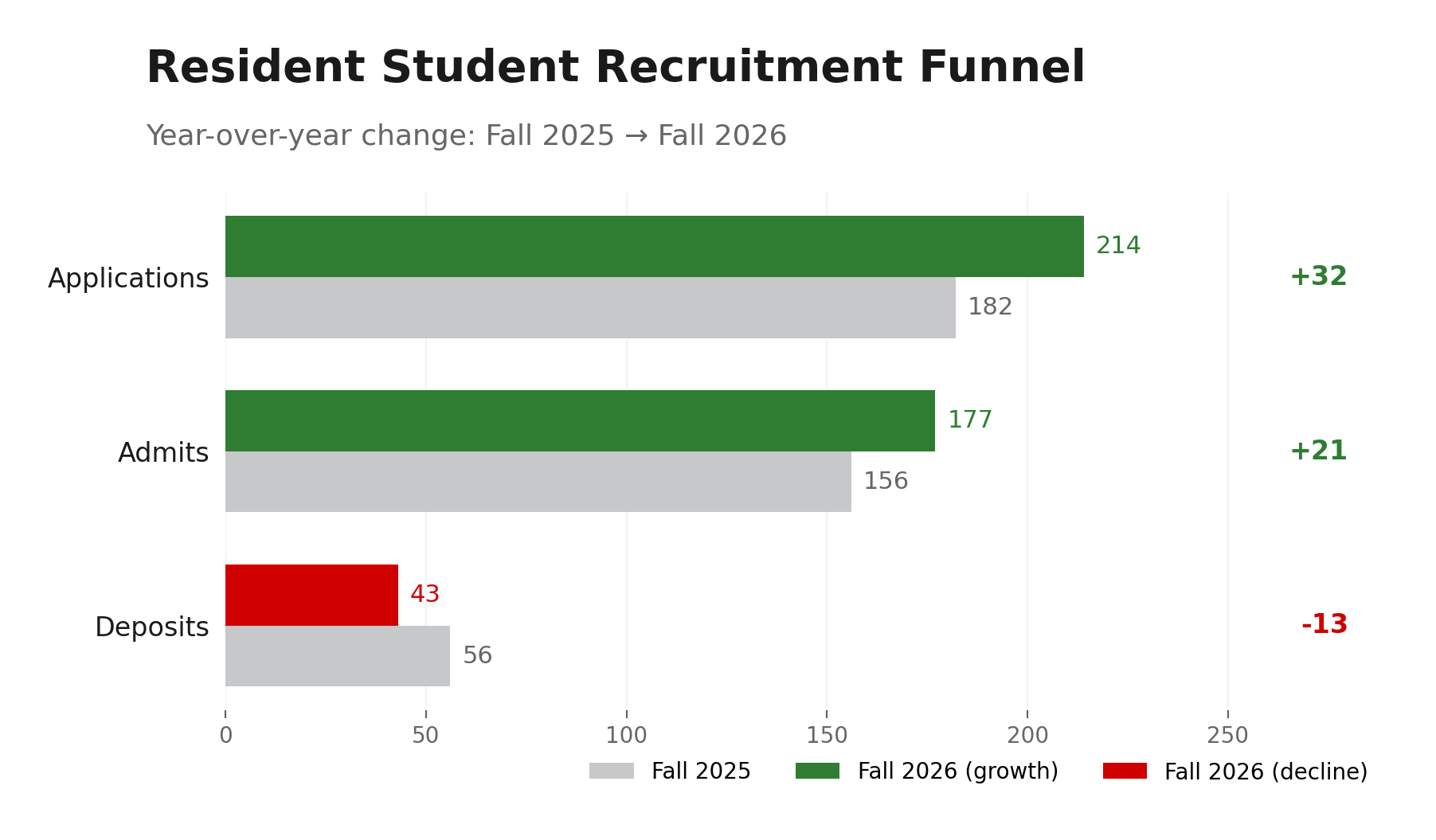

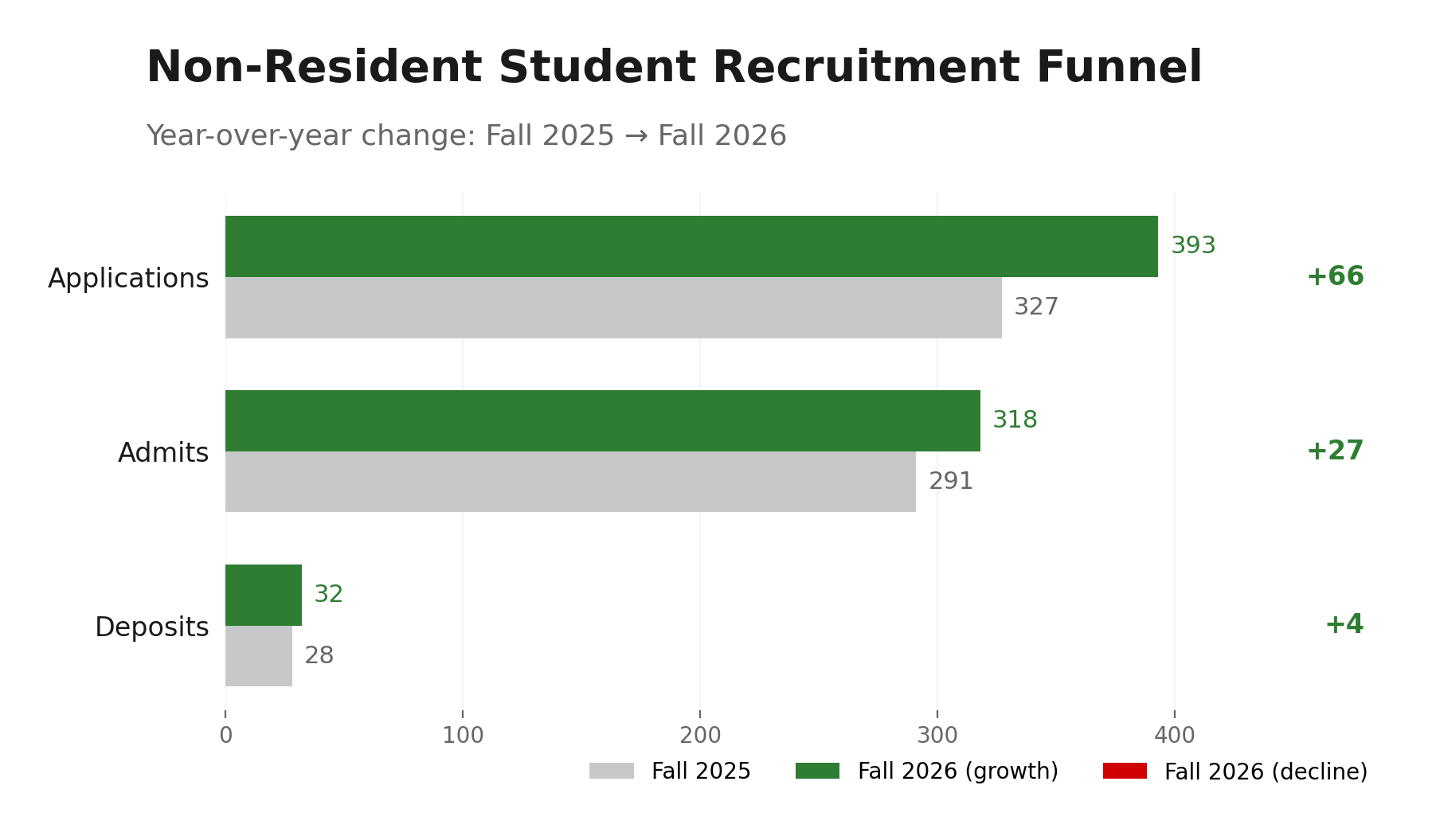

Both resident and non-resident populations show growth at the application and admission stages, indicating that interest is not weakening within either group. International student applicants and admits are down, which is not surprising given recent national and global dynamics. However, international students have not yielded enrollments in the past three recruitment cycles, so this decline does not materially affect our current position. As a result, deposit pressure is primarily a domestic issue, and within the domestic pool, it is most consequential inside Nebraska.

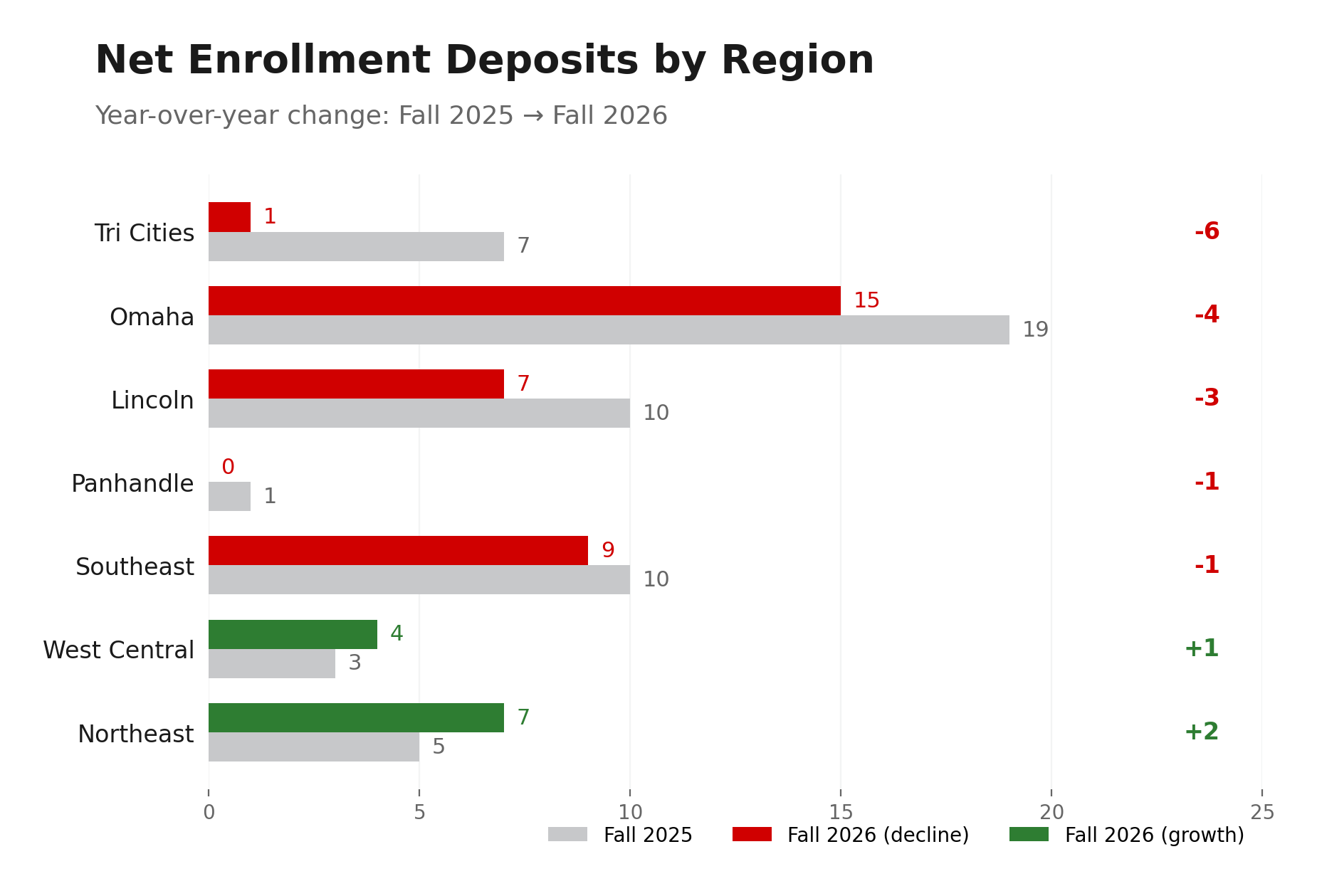

Within the state, the pattern is not a broad decline in demand. Instead, interest remains strong while conversion has softened in specific places. Omaha continues to generate the largest share of in-state applications and admits, but deposits are down sharply compared to recent cycles. This points to erosion in post-admit conversion rather than an application-generation problem. Because Omaha operates at scale, even small changes in yield rates produce an outsized impact on total enrollment. For Fall 2026, Omaha is therefore the single highest-priority region for yield strategy and execution.

Lincoln shows a modest decline in deposits compared to last year, which is important to acknowledge. However, this softening occurs within an otherwise stable and historically reliable pipeline. Application and admit volume remain strong, and year-over-year changes in Lincoln tend to be incremental rather than volatile. This makes Lincoln both a region to watch and a region where targeted yield reinforcement is likely to be effective. Sustaining Lincoln performance, and reversing a relatively small decline, is strategically important because the region consistently contributes to baseline enrollment and responds predictably to engagement efforts.

We are also seeing continued volatility in the Tri-Cities region. Application volume suggests students are still interested, but conversion from admit to deposit remains inconsistent or minimal. This pattern tends to reflect a late-stage decision gap, where students either do not see sufficient value, do not feel a sense of belonging, or do not receive timely reinforcement during the decision window. Because the region operates at a smaller scale, even meaningful improvements in yield would produce limited absolute gains in the short term. As a result, Tri-Cities remains an area for continued monitoring and deeper diagnostic work rather than primary near-term yield investment.

In contrast, Southeast and Northeast Nebraska remain relatively stable. Northeast Nebraska shows modest upward momentum that should be reinforced, while Southeast Nebraska continues to perform predictably across stages. West Central Nebraska remains smaller but merits monitoring because the deposit pipeline is thin and therefore vulnerable to small shifts.

Taken together, the Nebraska data suggest that the most immediate gains will not come from additional statewide application growth. The fastest path to improving Fall 2026 outcomes is improving admit-to-deposit conversion in Omaha, addressing early signs of softening in Lincoln, and reinforcing regions that are showing steady or improving momentum, while continuing to assess longer-term strategies for more volatile areas such as Tri-Cities.

High school pipelines

The high school lens further confirms that yield risk is not evenly distributed across the state. The schools that matter most this cycle are those that consistently generate admits but show uneven or soft deposit conversion, rather than schools that produce one-time applicants. Yield gains will come from focused decision-stage work on specific pipelines where we already have admits in hand.

The strongest concentration of yield opportunity is in the Omaha metro. Several schools that historically generate meaningful application and admit volume are under-converting this cycle. This group includes the Millard cluster (Millard West, Millard North and Millard South), as well as Omaha Burke, Omaha Central, Omaha North, Omaha Westview, and the Papillion-La Vista pipelines (Papillion-La Vista and Papillion-La Vista South). These schools are not just notable because they appear in the data; they matter because of the number of admitted students they represent. A modest improvement in conversion at these schools would produce measurable gains in deposits.

Lincoln schools form the next most important pipeline group. Lincoln Southeast, Lincoln East, Lincoln Southwest, Lincoln Northeast and Lincoln Pius X continue to produce steady applicant and admit volume. Conversion from admit to deposit, however, has softened relative to historical patterns and varies year to year. This suggests that Lincoln is not a top-of-funnel problem. It is a reinforcement problem at the decision stage. Lincoln does not require fundamentally different recruitment activity, but it does require more intentional post-admit communication and engagement to maintain baseline performance.

Finally, suburban growth pipelines warrant protective attention, not because they are currently failing, but because they are emerging and therefore easy to lose without early yield reinforcement. Schools such as Gretna and Gretna East, Elkhorn South and Elkhorn North, and Standing Bear are showing sustained interest. These pipelines should be treated as assets to protect, ensuring that applicant growth translates into enrollment rather than leakage to competing institutions.

Overall, the high school analysis indicates that broad outreach is unlikely to be the highest-impact lever for this cycle. The higher-return approach is targeted, structured yield execution focused on a defined set of high-volume Omaha and Lincoln schools and on suburban pipelines where growth is present but not yet secured.

Out-of-state markets and summer melt risk

Out-of-state enrollment continues to perform well overall. Across most out-of-state markets, applications, admits and net deposits are holding steady or increasing. Unlike the in-state story, this population is not currently driving deposit-stage risk.

That said, out-of-state enrollment carries a different type of vulnerability. These students are more likely to be affected after deposit, particularly during summer melt, due to distance, cost, housing logistics, competing offers and the practical barriers associated with relocating. Because the out-of-state market is more diffuse, the appropriate strategy is not expansion into new territories. The priority is to monitor which markets are growing or declining and to manage yield beyond the point of deposit through proactive summer engagement.

Several markets account for a disproportionate share of out-of-state volume and should be monitored closely throughout the spring and into summer. Chicagoland, Kansas City, the Twin Cities, Texas, Colorado and Wisconsin remain the most consistent contributors and continue to yield deposits. In addition, a set of secondary markets shows more volatility, where application interest does not always translate cleanly into enrollment. The risk here is not currently visible in the deposit count, but it can surface later through melt. The operational implication is clear: out-of-state deposits should be treated as a population requiring sustained summer reinforcement, particularly in high-volume markets, with early intervention when engagement declines or uncertainty increases.

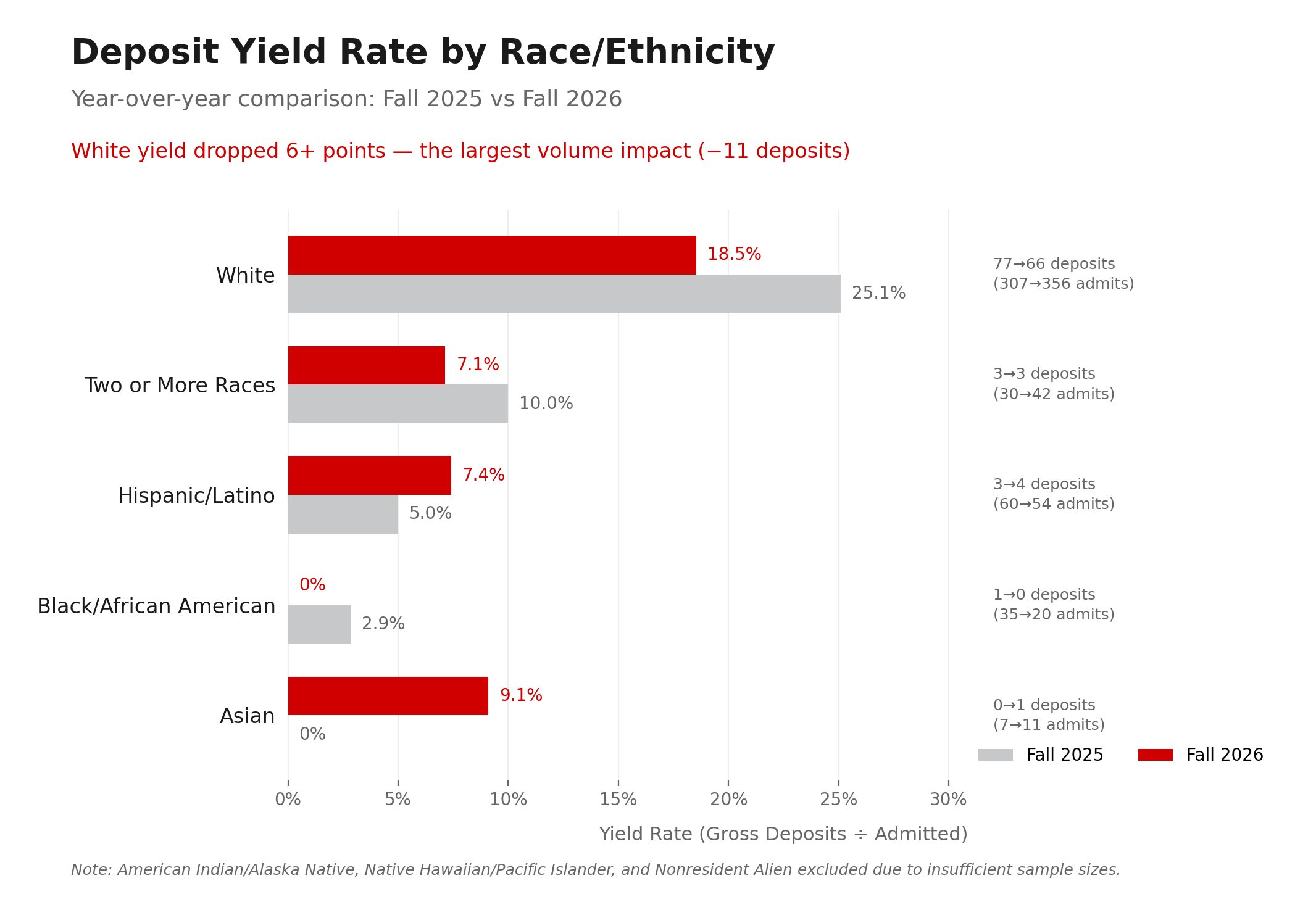

Race and ethnicity

Across racial and ethnic groups, the top of the funnel remains generally healthy, but yield patterns indicate emerging and concentrated pressure points. White students continue to account for the largest share of applications and admits, and net deposits have declined from 77 at this time last year to 66, indicating erosion at scale. Because this group is large, small yield shifts translate into meaningful changes in total deposits.

Hispanic/Latino students show a different pattern that is important to interpret carefully. Applications increased to 74 for Fall 2026, but net deposits remain flat at four. This does not currently drive overall enrollment risk because the deposit volume is small, but it does signal softening conversion. When interest rises, and deposits do not move, the caution is not that the pipeline is shrinking. The caution is that the pipeline is not converting and could represent an opportunity if yield strategies are calibrated appropriately.

The most concerning pattern appears among Black/African American students. Applications remain comparatively high at 37, but admits declined sharply from 35 in Fall 2025 to 20, and net deposits remain at one. This indicates pressure at two points: a narrowing of the funnel at admission and a continued breakdown at the conversion stage. This is one of the clearest areas where deeper diagnostic work is needed, as it may reflect a combination of academic profile shifts, competitive dynamics and decision-stage engagement barriers. It is also important to note that Omaha is both our largest yield-risk region and a key source market for Black/African American applicants. That overlap suggests the issue is not isolated to a single variable and reinforces the likelihood that the highest-impact interventions will be regionally grounded, post-admission, and intentionally designed to support belonging, clarity and confidence during the decision window.

Gender

By gender, application and admit growth are present for both female and male students, indicating that interest remains strong across genders. At the same time, net deposits are down for both groups, with female net deposits declining from 44 to 39 and male net deposits declining from 40 to 36. Because the decline is proportional and not concentrated, gender does not appear to be a primary driver of Fall 2026 enrollment pressure. This pattern again points to broader decision-stage dynamics rather than a single demographic segment driving outcomes.

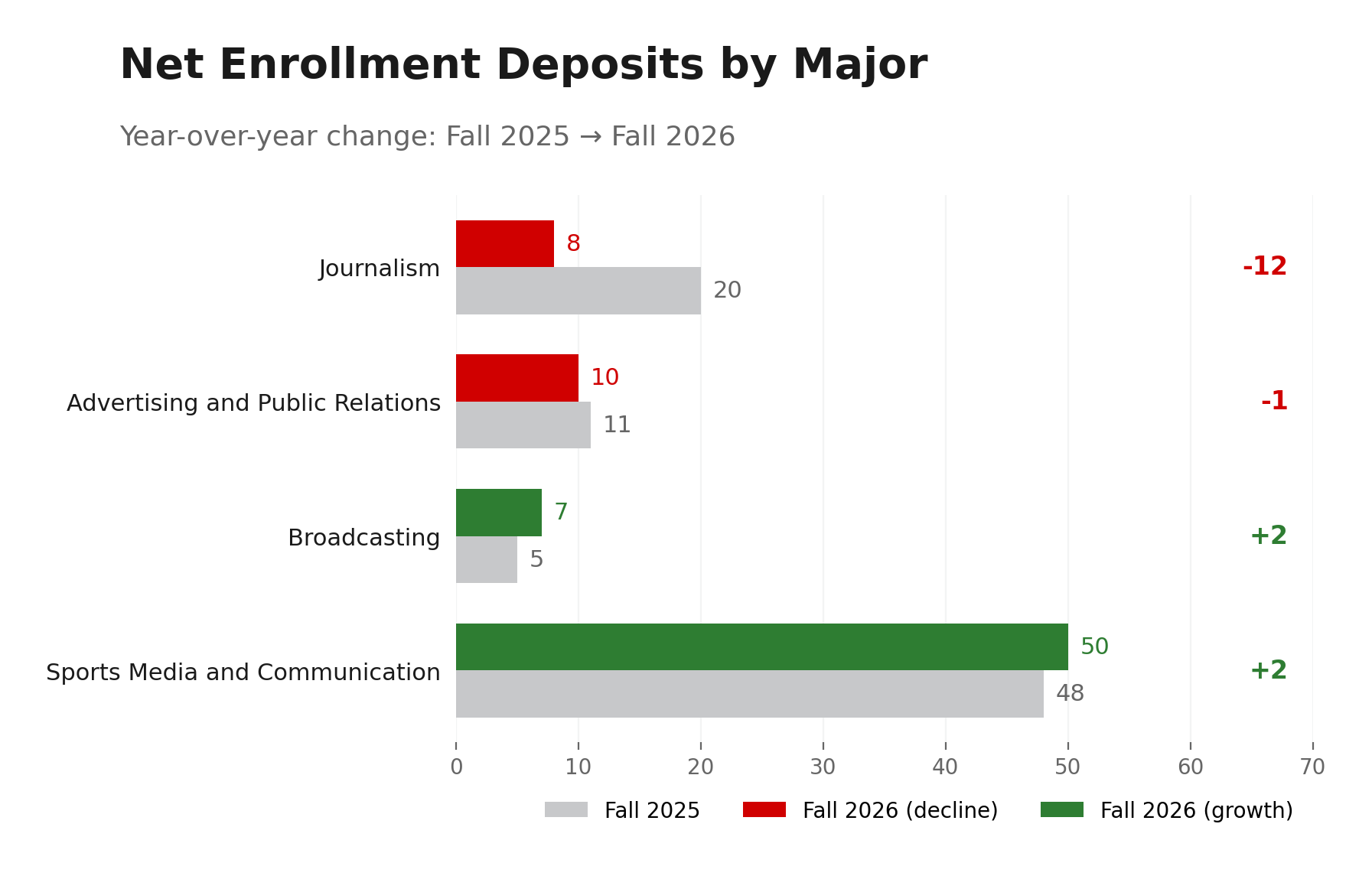

Major

The major lens helps clarify where growth is coming from and where yield erosion is undermining progress. Application growth is heavily concentrated in Sports Media and Communication, which increased from 322 applications to 402 and now represents roughly two-thirds of the applicant pool. Admits rose accordingly, and net deposits increased slightly from 48 to 50. Sports Media remains the college’s primary enrollment driver. However, because of its scale, even modest yield improvement would produce significant gains. Growth at the top of the funnel is translating into only incremental deposit growth, indicating that the Sports Media strategy now needs to shift from generating volume to tightening conversion.

Journalism shows the clearest yield erosion. Applications held flat at 110 year-over-year, but net deposits fell sharply from 20 to 8. Advertising and Public Relations shows a similar, though smaller-scale pattern, with applications essentially flat and net deposits down slightly from 11 to 10, continuing a longer-term decline from its Fall 2024 high. Broadcasting is smaller in volume but improved modestly, with net deposits increasing from five to seven. Taken together, the majors indicate that Fall 2026 yield work should prioritize post-admit conversion in Journalism and Advertising and Public Relations while maintaining momentum in Sports Media, where even small conversion gains would produce an outsized impact due to scale.

What the data is telling us

The central conclusion of this mid-year check-in is that Fall 2026 enrollment pressure is not driven by a lack of demand. It is driven by post-admission conversion, concentrated regionally in Nebraska, specifically Omaha, Lincoln and the Tri-Cities and reinforced by patterns at key high schools and in certain majors. This is not a cycle where additional application growth is likely to be the highest-return lever. The highest-return lever is disciplined yield execution aimed at a defined set of pipelines where we already have admits but are not consistently winning the final decision.

At the same time, out-of-state deposits should be treated differently from in-state deposits. The out-of-state pipeline is strong at deposit, but the risk shifts later into summer melt. For this population, success depends on monitoring market trends and sustaining engagement beyond deposit through the summer.

Planned yield activities for Spring 2026

The enrollment patterns outlined above make clear that the greatest opportunity for Fall 2026 lies in focused, decision-stage engagement with students who have already been admitted. In response, the yield strategy for the spring semester is intentionally layered, combining digital outreach, peer connection and high-touch, in-person experiences designed to reinforce value, belonging and academic fit.

First, the college will partner closely with the Office of Admissions to deploy a targeted digital marketing campaign focused specifically on yield conversion rather than application generation. This campaign will concentrate on admitted students and will be tailored to key populations identified in the data, including Nebraska residents in Omaha and the Tri-Cities, students admitted to Journalism and Advertising and Public Relations, and high-volume out-of-state markets. Messaging will emphasize academic experience, student outcomes and community, reinforcing reasons to choose the college at the point of decision rather than introducing new information late in the cycle.

Second, applications have opened for the ambassador mentoring program, which pairs admitted students with current student ambassadors for structured engagement throughout the spring. This program is designed to address one of the clearest signals in the data: uncertainty late in the decision process. By connecting admitted students with peers who can speak directly to academic life, involvement opportunities and the student experience, the mentoring program creates space for authentic, informal conversations that often influence final decisions more than traditional recruitment messaging alone.

Beginning in February, the ambassador team will also conduct a calling campaign to all admitted students. These calls are intended to be conversational rather than transactional, giving students an opportunity to ask questions, voice concerns and feel personally welcomed into the college community. This effort is particularly important for high-volume Nebraska schools and majors where yield has softened, as even small improvements in conversion in these populations can materially affect final enrollment.

The college will also host a series of ambassador-led virtual chats throughout the spring semester. Three online meetups will be offered at strategic points in the cycle, providing admitted students with repeated opportunities to connect informally with current students, ask questions and learn more about academic and co-curricular life in the college. These sessions are intentionally designed to lower barriers to engagement for students who cannot visit campus or who are still building confidence in their decision. By spacing the virtual chats across the semester, the college can reinforce connection over time rather than relying on a single touchpoint, while also using participation as an early indicator of yield strength and potential summer melt risk.

Finally, in partnership with the Office of Admissions, the college will host an Admitted Students Day on March 28. This event is a critical yield moment for Fall 2026. Admitted students will be invited to spend time in the college, engage directly with faculty and current students, tour Andersen Hall and participate in hands-on activities connected to academic programs. The goal is to move students from abstract interest to tangible experience, helping them visualize themselves in the space, the curriculum and the community before making a final commitment.

Together, these activities reflect a deliberate shift from broad recruitment to targeted yield execution. Rather than expanding the funnel, the focus for Spring 2026 is on strengthening connection, clarity and confidence among students who are already considering the college and guiding them through the final decision in a way that aligns with the patterns reflected in the data.

How can faculty help?

- Be present at Admitted Students Day (March 28).

The college will follow up with details about opportunities to engage informally with admitted students during Admitted Students Day, including participating in hands-on activities or talking through what the first year looks like in your program. Direct interaction with faculty is often a deciding factor for students at this stage. - Send a short note to admitted students in your program.

Later this spring, the college will reach out with a request for a brief, personalized email to admitted students in select programs. These messages would welcome students, share why you enjoy teaching in the program or invite them to Admitted Students Day. Even a short note can meaningfully influence final enrollment decisions, particularly in programs where yield has softened. - Reinforce belonging in every interaction.

As you connect with admitted students throughout the spring, conversations should emphasize encouragement and clarity rather than evaluation. Faculty affirmation plays a critical role in helping students, especially first-generation students and students from underrepresented backgrounds, feel confident in their decision to enroll.