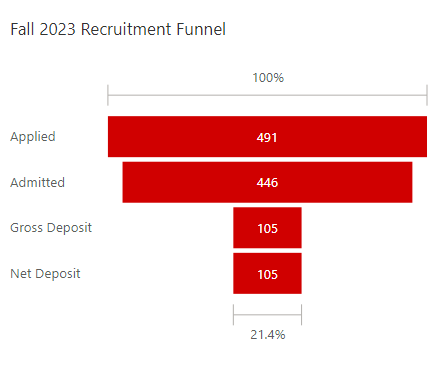

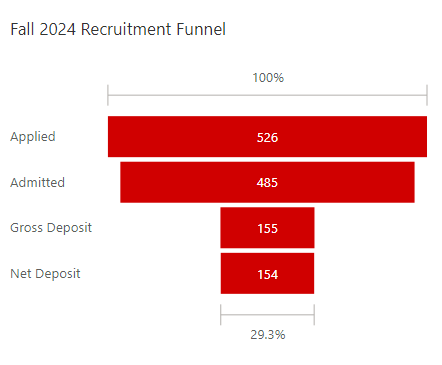

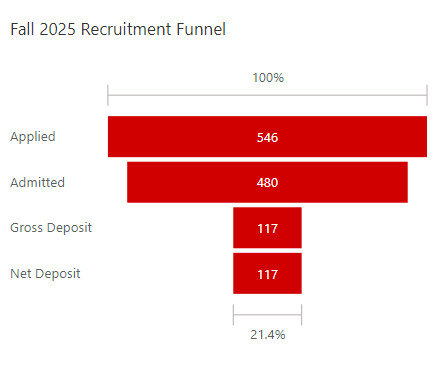

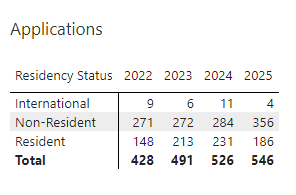

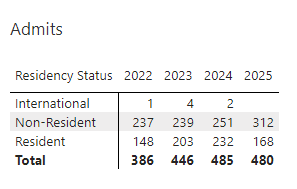

As of February, the Fall 2025 recruitment cycle presents a mixed outlook compared to previous years. Applications have increased by 3.8% from 2024 and 11.2% from 2023, signaling strong interest in the program. However, the number of admitted students has declined slightly by 1.0% from last year, though it remains 7.6% higher than in 2023. This suggests that while prospective student interest continues to grow, the admissions process may be moving more slowly than in previous cycles.

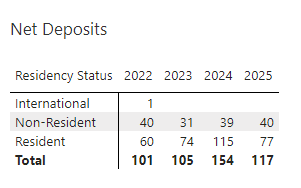

The most concerning trend is the decline in gross and net deposits, which are down 24% from 2024. This indicates that fewer admitted students are committing financially at this stage. However, compared to 2023, when the second-largest class in history enrolled, deposits are still 11.4% higher, suggesting that Fall 2025 remains on track to yield a strong incoming class.

Based on current trends, Fall 2025 is unlikely to surpass the record-breaking Fall 2024 class of 215 students. However, if deposit rates stabilize, the class is expected to match or slightly exceed the 181 students enrolled in Fall 2023, which was our second-largest class in history. To achieve this, increasing engagement with admitted students, refining yield strategies, and closely monitoring competitor activity will be essential over the next several months.

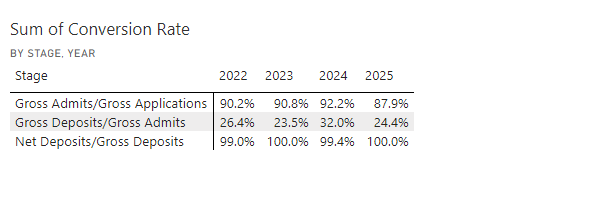

Conversion Rates

The Fall 2025 cycle is showing a decline in key conversion rates compared to previous years. The conversion from applications to admits has dropped by 4.7% from 2024 and 3.2% from 2023. Feedback from campus staff indicates that staffing shortages in the Office of Admissions have led to delays in processing applications and sending decisions. These delays may cause prospective students to lose interest, accept offers from competing institutions, or disengage from the process altogether.

The conversion from admitted students to deposits is the most significant concern. Deposits have dropped by 24% from 2024, meaning that fewer admitted students are making a financial commitment. However, the rate is slightly improved compared to 2023, showing that while the decline from last year is substantial, the overall numbers are still within a historically strong range. Once students deposit, the conversion to net deposits remains at 100%, indicating that those who commit financially follow through with enrollment.

To improve the Fall 2025 class size, the college will prioritize engagement with admitted students, encouraging deposits and ensuring those who have deposited remain committed. Efforts will focus on personalized outreach, faculty and peer engagement, and opportunities for admitted students to connect with the college and their future classmates. While the admissions process is outside the college’s direct control, we will advocate for the Office of Admissions to assess staffing allocations and streamline decision timelines to mitigate delays. With net deposits remaining high, the primary challenge is increasing the number of students who take the critical step of making a deposit.

Residency

The Fall 2025 recruitment funnel highlights distinct trends among resident, non-resident, and international applicants. Resident applications have declined, with 186 applications in Fall 2025 compared to 231 in 2024. Admissions have also decreased, with 168 students admitted this year versus 232 last year. Gross deposits from resident students have dropped significantly, falling from 115 in 2024 to 77 in 2025. Net deposits follow a similar downward trajectory, indicating potential challenges in converting admitted resident students into enrolled students.

Non-resident applications have increased to 356 in Fall 2025, up from 284 in 2024. Admissions have also risen, with 312 students admitted compared to 251 last year. However, gross deposits remain unchanged at 40, suggesting that while more non-resident students were admitted, they are not converting to deposits at a higher rate. Net deposits have remained stable at 40 in both 2024 and 2025.

International applications dropped significantly, with only four applicants in Fall 2025 compared to 11 in 2024. No international students were admitted this cycle, compared to two in 2024. This marks a substantial decline in engagement and conversion for this group.

|

|

|

The decline in deposits from resident students is the most pressing concern, even as non-resident applications and admissions have increased. Strengthening deposit conversion efforts among resident students will be critical for maintaining overall enrollment stability. Additionally, international recruitment strategies may need to be reassessed given the sharp contraction in this applicant pool.

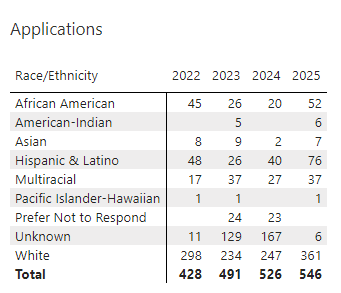

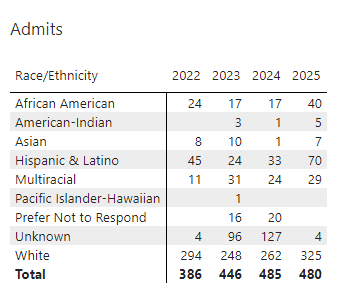

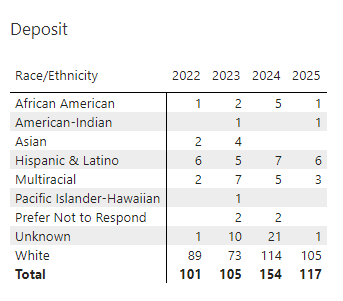

Race/Ethnicity

Comparing Fall 2025 to previous years, distinct patterns emerge in how different racial and ethnic groups are progressing through the recruitment funnel. African American student applications increased to 52 in Fall 2025, up from 20 in 2024 and 26 in 2023. However, the admit rate has declined, with only 40 admitted this year compared to 17 in 2023. Deposits remain extremely low, with only one African American student making a deposit in Fall 2025, down from five in 2024 and two in 2023, signaling a critical challenge in moving admitted students to enrollment.

Among Hispanic and Latino students, applications rose to 76 in Fall 2025, up from 40 in 2024 and 26 in 2023. The admit rate remains strong at 70 admitted students this year, compared to 33 in 2024 and 24 in 2023. However, deposit rates remain low, with only six students making a deposit this cycle, similar to previous years.

Asian student applications have remained steady, with seven in Fall 2025, two in 2024, and nine in 2023. Admit rates are high, but deposits remain a challenge, with no Asian students depositing this cycle.

Multiracial students saw 37 applications in Fall 2025, up from 17 in 2024 and 16 in 2023. Admitted numbers have also increased, but deposit rates remain low, reinforcing a broader trend of conversion challenges.

|

|

|

Overall, the total number of applications increased to 546 in Fall 2025, up from 526 in 2024 and 491 in 2023. However, gross deposits have dropped from 155 in 2024 to 117 in 2025, underscoring the need for stronger efforts in converting admitted students into enrolled students.

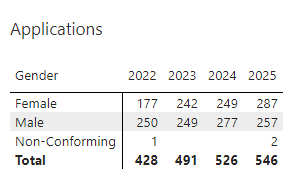

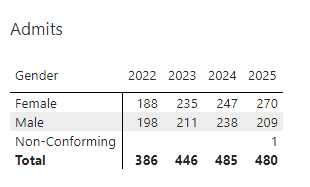

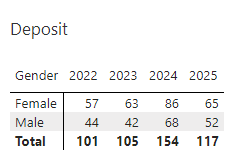

Gender

The Fall 2025 recruitment funnel data reveals shifts in gender trends. Applications from female students increased to 287, surpassing male applicants at 257. This marks a shift from Fall 2024, when there were more male applicants (277) than female applicants (249). The number of admitted female students remains strong, with 270 admitted in Fall 2025, compared to 247 in 2024 and 235 in 2023. However, admitted male students declined from 238 in 2024 to 209 in 2025, indicating fewer male applicants advancing through the funnel.

Deposit rates have declined for both male and female students. Female deposits dropped from 87 in 2024 to 65 in 2025, while male deposits fell from 68 to 52. While female students now make up a larger share of the deposited student population, overall yield from admitted students has softened across the board.

|

|

|

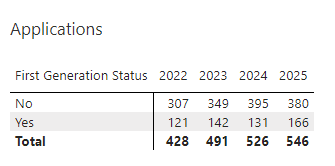

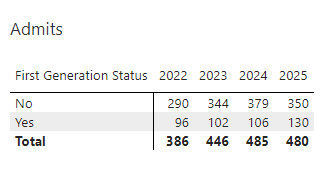

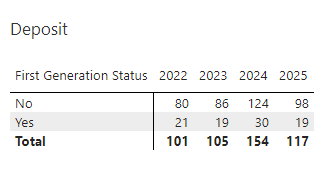

First Generation

First-generation student applications increased to 166 in Fall 2025, up from 131 in 2024 and 142 in 2023. Admissions also increased, with 130 first-generation students admitted in 2025, compared to 106 in 2024 and 102 in 2023. However, the deposit rate remains a challenge, with only 19 first-generation students making a deposit in 2025, down from 30 in 2024.

For non-first-generation students, applications remain the majority of the applicant pool at 380 in 2025, slightly down from 395 in 2024. Deposits remain significantly higher than for first-generation students, suggesting that additional engagement and support may be needed to encourage first-generation students to commit to enrollment.

|

|

|

Major

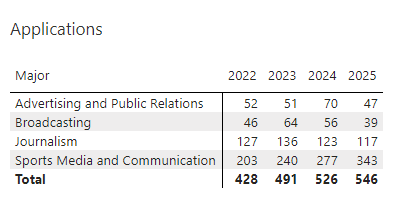

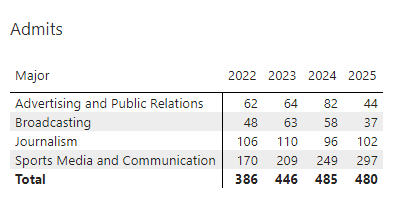

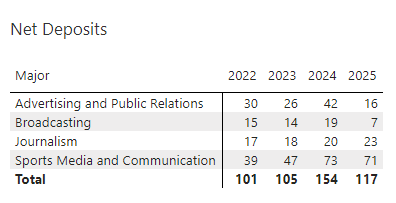

The Fall 2025 recruitment funnel shows notable differences in how students move through the process based on their chosen major.

|

|

|

Sports Media and Communication remains the largest major in terms of applications, with 343 applicants in Fall 2025, down from 358 in 2024 but still the most popular choice. The admit rate for this major remains strong, with 281 admitted students, though this is slightly lower than the 296 admitted in 2024. Deposits for this major are down slightly, with 39 gross deposits in 2025 compared to 42 in 2024, indicating a potential softening in final enrollment numbers.

Journalism saw 117 applicants in 2025, a small decrease from 123 in 2024. The admit rate for Journalism remains steady, with 102 admitted students this year compared to 96 last year. Deposits have increased slightly, with 23 students making a deposit in 2025 compared to 21 in 2024, showing positive movement in yield.

Advertising and Public Relations applications have declined significantly, dropping from 70 in 2024 to 47 in 2025. Admitted student numbers have also decreased, with only 44 admitted in 2025 compared to 82 in 2024. Gross deposits for this major are also down, with only 16 students making a deposit this cycle compared to 42 in 2024, indicating a substantial drop in conversion rates. This major is seeing the sharpest decline at multiple points in the funnel.

Broadcasting has also experienced a decline, with applications dropping from 56 in 2024 to 39 in 2025. Admissions numbers are similarly down, with 37 admitted students this year compared to 58 in 2024. Deposits have decreased from 19 in 2024 to only 7 in 2025, suggesting a larger drop-off in student commitment to this major.

Across all majors, deposit rates have softened compared to previous years, with the most significant declines seen in Advertising and Public Relations as well as Broadcasting. Journalism remains relatively stable, while Sports Media and Communication still attracts the largest pool of applicants but is showing some signs of slowing deposit conversion.

Conclusion

The Fall 2025 recruitment funnel demonstrates a strong interest in the program, with application numbers increasing across most categories. However, conversion rates from admitted students to deposits have softened, highlighting the need for targeted engagement strategies. The primary challenges include lower deposit rates among resident students, first-generation students, and certain academic majors. Moving forward, efforts will focus on strengthening outreach to admitted students, enhancing engagement opportunities and advocating for improvements in the admissions process to ensure a strong final enrollment.